|

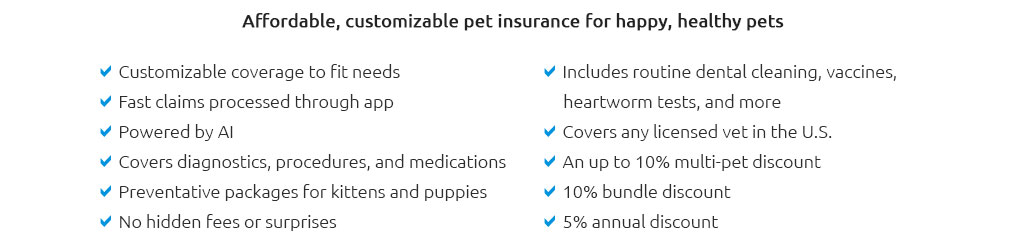

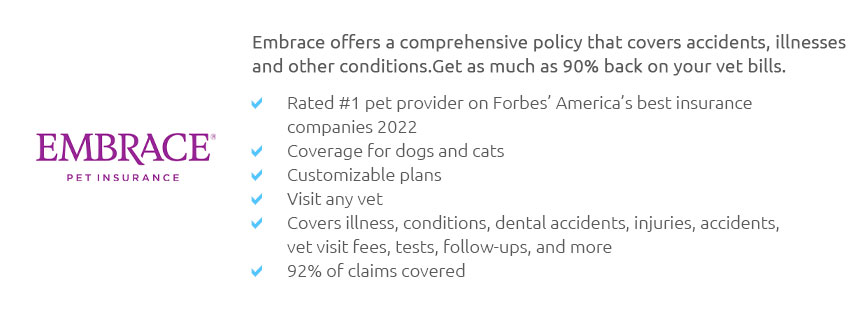

cheap comprehensive pet insurance that keeps you in controlYou want clear coverage and predictable costs, not surprises. I'll walk you through building a plan that stays affordable while protecting the care your pet actually needs. Step by step, with control and clarity in mind. First, define what "comprehensive" means for youComprehensive should cover more than sudden accidents. It should include the expensive, slow-burn stuff that really hurts budgets. - Accidents: injuries, swallowed objects, lacerations.

- Illnesses: infections, chronic conditions, cancer.

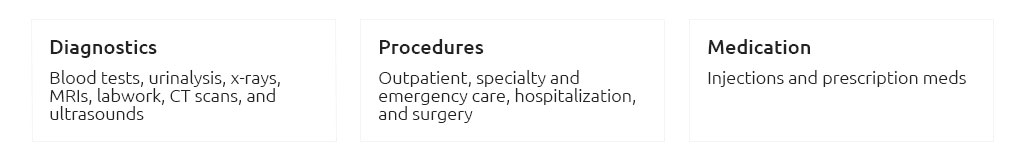

- Diagnostics: X-rays, ultrasound, lab work, MRI/CT where available.

- Medications and treatments: ongoing prescriptions, chemo, rehab, alternative therapies if allowed.

- Dental illness: not just accidents to teeth; ideally periodontal care related to illness.

- Behavioral treatment: sometimes an add-on; useful for anxiety or reactivity.

Note: pre-existing conditions are usually excluded; waiting periods apply. That isn't a flaw, just a boundary you plan around. Step-by-step: build a plan that stays cheap without cutting corners- Set a realistic annual limit. Pick a cap that matches local vet costs. Many issues fall under midrange limits; "unlimited" can be nice, yet you might pay more than you need.

- Dial in deductible and reimbursement. Higher deductible, lower premium. Choose a deductible you can pay today without stress. A 70 - 80% reimbursement often balances savings and protection.

- Check waiting periods and exclusions. Look for orthopedic waiting rules, bilateral condition clauses, and how "curable" pre-existing issues are treated.

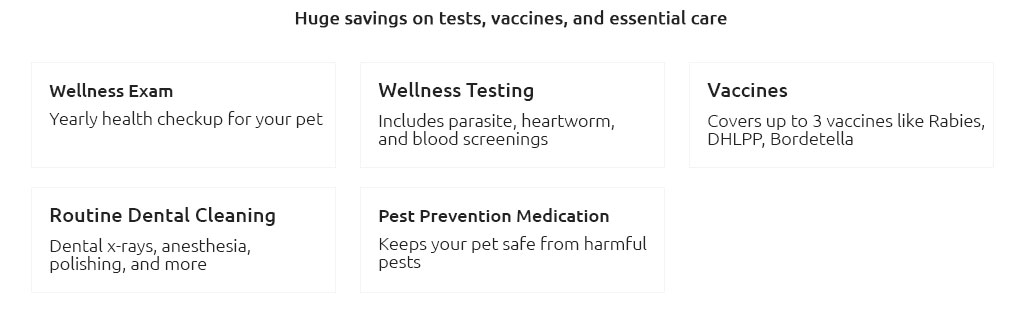

- Skip pricey add-ons unless they serve you. Wellness/routine care can be convenient, but it sometimes costs more than it returns. I favor keeping illness/accident strong and paying routine costs out of pocket.

- Use legitimate discounts, not gimmicks. Multi-pet, pay-annually, and claims-free credits are normal; bundling with unrelated products often isn't necessary.

- Compare apples to apples. Quote the same deductible, reimbursement, and limit across plans. Then estimate your effective annual cost: premium + likely out-of-pocket for a typical year.

- Read the policy wording. Especially definitions, sub-limits (e.g., rehab), exam fees, and how rate increases are handled at renewal.

A quick real-life momentSaturday, your cat starts limping after a leap from the fridge. The urgent visit, X-rays, pain meds, and follow-up come to $480. You pay, file a claim in the app while sipping coffee in the parking lot, and get reimbursed a few days later: with a $200 deductible and 80% reimbursement, you receive $224 back on the eligible $280 balance. Not a windfall - just steady control over a stressful weekend. What keeps costs low over time- Preventive care choices. Good dental hygiene and weight control reduce illness claims. You may not need a wellness add-on to do this well.

- Right-sized deductible. Start with what you can afford now; as your emergency fund grows, consider nudging the deductible up to lower premiums.

- Stay put if coverage fits. Switching later can reclassify prior issues as pre-existing. Loyalty perks can help, though they aren't everything.

Common myths, gently checked- "Cheapest premium is best." I softly disagree: the cheapest month-to-month can become the most expensive after sub-limits and exclusions. Aim for lowest lifetime cost with clear coverage.

- "Self-insure only." That can work with a strong emergency fund and discipline. If you prefer predictable budgeting and fewer large spikes, a lean policy helps.

- "Unlimited or nothing." Unlimited has value, but a sensible limit that matches real vet bills may deliver better value for many pets.

Checklist before you click buy- Annual limit, deductible, reimbursement chosen for your cash flow.

- Exam fees covered? Any sub-limits for rehab, dental illness, or imaging?

- Waiting periods, orthopedic rules, bilateral clauses understood.

- How renewals and rate increases are determined.

- Claim method speed and typical payout times.

- Exclusions for breed-specific or hereditary issues clarified.

Clarity glossary- Annual limit: max paid in a policy year.

- Per-condition limit: max per illness or injury; can reset or be lifetime.

- Deductible: what you pay before reimbursement applies (annual or per-condition).

- Co-insurance: your share after deductible (e.g., 20%).

- Reimbursement rate: insurer's share after deductible.

- Waiting period: time before coverage kicks in for certain issues.

- Bilateral condition: an issue on one side may affect coverage on the other.

- Pre-existing: signs or symptoms before start date; often excluded.

Your next small moveGather recent vet records, decide a deductible you can comfortably pay today, and request three like-for-like quotes. Read the sample policy for fifteen quiet minutes. You'll feel the difference: fewer unknowns, more clarity, and the steady control you want over your pet's health costs.

|

|